A repo rate cut would ease the burden of rising loan interest rates and stabilize the market, encouraging investment.

As Shaktikanta Das finishes up his tenure as India’s central bank governor, handing over the reins to a career bureaucrat, many have praised his performance as a relative outsider who leaned on diplomacy to propel the world’s fastest-growing major economy to new heights.

Over the past few years, Das steered the Reserve Bank of India through pandemic lockdowns and digitization of numerous facets of life in the South Asian nation. He held his seat for six years, making him the second-longest-serving leader of the central bank.

“I have tried to give my best to the institution,” he said at a press event on Tuesday. Asked if he plans to return to public office after stepping down from the RBI, Das said: “I will think about it.”

His achievements are noteworthy partly because many predicted he would fail. When India named Das to lead the RBI in 2018, critics pointed to his lack of formal economic training and the role he had played in a failed attempt to root out black money by banning most currency notes.

Though many expected the government to extend Das’s tenure — and tied the final choice of Sanjay Malhotra to recent friction with officials — he’s nonetheless leaving his post on Tuesday with plenty of fans.

“If you had asked me in 2018 if Das was the right choice, I would have expressed doubt,” said Amol Agrawal, who teaches economics at Ahmedabad University. “Yet here we are in 2024, standing strong.”

Das’ adaptability didn’t mean perfection. Described by colleagues as mild-mannered and disciplined, he occasionally faced criticism for micromanagement by commercial bankers. And while diplomatic, Das wasn’t afraid to go toe-to-toe with India’s government or diverge from other central banks that maintained continuity with stances held by the US Federal Reserve.

Yet Das’ peers credited him with understanding his limitations as a non-economist. They say he kept his focus on one thing: preserving India’s financial stability.

That mission took various forms, including building up the world’s fourth-largest foreign exchange reserve and ensuring stability of the rupee.

By many accounts, Das was also an effective communicator with the markets, framing low bond yields as a “public good” and helping develop a sophisticated digital payments system that operates round-the-clock. He also ramped up adoption of a mobile platform known as Unified Payments Interface, which is now used to pay for everything from electricity bills to rickshaw rides.

“He’s a consensus builder,” said Soumya Kanti Ghosh, Chief Economic Advisor of the State Bank of India.

Das, a civil servant who was a member of India’s 15th Finance Commission, cultivated a more collaborative relationship with the central government compared to Urjit Patel, his predecessor.

Das mostly refrained from public criticism of government policies, though he was vocal about issues he perceived as threats to financial stability. Notably, he strongly opposed legalization of private cryptocurrencies, calling them a “ponzi scheme.”

Behind the scenes, Das also resisted using the RBI’s foreign exchange reserves for infrastructure projects and he opposed increasing foreign ownership of Indian debt, citing potential risks to market stability.

India’s inclusion in JPMorgan Chase & Co’s emerging markets bond index was delayed partly because of hesitation within the RBI, according to people familiar with the matter. The central bank didn’t respond to a request for comment.

Though Das was widely expected to get an extension, events in recent days suggested change might be afoot. The government kept silent about his future until Monday, a day before his term was scheduled to end.

Reasons for the apparent pivot are still murky. During his final policy announcement last week, Das held interest rates steady, despite pressure from the government to ease them amid an unexpected slowdown in economic growth. In keeping the policy repo rate unchanged at 6.5%, Das said the RBI’s legal mandate was to control inflation.

In a note, Nomura Holdings Inc. analysts led by Sonal Varma described a “stark divide” between the government and Das. Over the past few weeks, finance minister Nirmala Sitharaman and trade minister Piyush Goyal advocated for countercyclical monetary policy, such as rate cuts. But Das wanted to keep rates steady during a December 6 policy meeting.

Das leaves at a time when global markets are nervous about US President-elect Donald Trump’s threats of higher tariffs on places including China, Mexico and Canada. In the last six years, the RBI has focused on financial and exchange rate stability. Malhotra will likely focus on protecting the rupee amid a potential tariff war.

Even so, many agree that Das has built a strong foundation for his successor. Economists credit him with transforming the RBI into a nimbler, more modern version of itself.

“A repeat of Das is unlikely,” said Agrawal of Ahmedabad University.

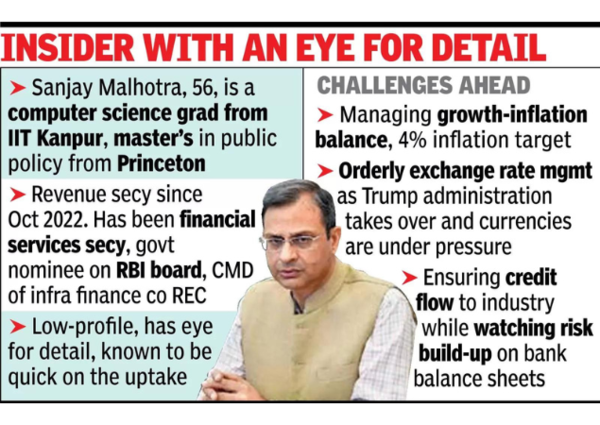

NEW DELHI: Government on Monday sprung a surprise by naming revenue secretary Sanjay Malhotra, 56, as the 26th Reserve Bank of India governor to replace Shaktikanta Das, whose six-year stint on Mumbai’s Mint Road ends on Tuesday.

After weeks of suspense, the appointments committee of cabinet zeroed in on Malhotra hours before Das’s tenure was to end. Like his predecessors, Malhotra has been given a 3-year term starting Dec 11.

The appointment was a surprise for Malhotra himself and he was said to be coming to grips with the development as he left North Block on Monday evening.

IAS topper from 1990 batch, Malhotra – who has been poring over Budget proposals and preparing for the crucial GST Council meeting later this month – will leave IAS more than three years before his age of retirement to take up one of the most powerful jobs in the country.

Malhotra is a computer science graduate from IIT Kanpur and has a master’s from Princeton University.

Hailing from Bikaner, Malhotra will be the third IITian, after Raghuram Rajan (IIT Delhi) and D Subbarao (IIT Kharagpur) to occupy the crucial 18th floor office in RBI, and also the second Malhotra – after R N Malhotra (1985 to 1990) – to lead the regulatory agency.

But the similarities end there. In opting for Malhotra, the Modi govt has signalled its preference for a civil servant to run Reserve Bank after Das, also from IAS, ensured smooth coordination with Centre, ending years of tussle between the finance ministry and the central bank over multiple issues – from the trajectory of interest rates to managing govt borrowings, the formula for paying dividends and recognising bad debts of banks.

While Malhotra has been dealing with Centre’s revenues ever since he moved to North Block in Oct 2022, he is no stranger to financial services. Between Feb and Oct 2022, he was secretary in the department of financial services, overseeing state-owned banks and insurance companies.

.During this period, he was also the government’s nominee on RBI’s central board. Before that, he spent two years as the chairman and managing director of REC, the state-run infrastructure finance company. Malhotra came into his own when he shifted to the revenue department.

The low-profile bureaucrat has an eye for detail, which officials said was visible during the pre-Budget meetings when he would take up issues related to tax returns with the direct and indirect tax brass. “He knows the details himself, so it is difficult to bluff him. Although he is soft-spoken, he can be assertive,” said an officer, who has attended several of his meetings.

Another officer said that he would even bring up latest court rulings during his meetings with revenue officials, asking them to factor those in. “He has a good sense of how the economy will respond to a certain proposals and quickly understands the requirements of the job,” the official said, adding that the way Malhotra led the entire Financial Action Task Force (FATF) review also worked in his favour as India came out as one of the top performers.

Always smartly turned out, Malhotra invariably engages attention with his colourful ties that are well coordinated with his suits, He enjoys the trust of finance minister Nirmala Sitharaman who often turns to him for technical input in complicated tax matters.

Whether it was dealing with tax deduction on virtual digital assets or the revamped capital gains regime, the Rajasthan-cadre officer was willing to tackle issues even when public opinion did not favour the proposals. He was equally at ease dealing with GST issues: a vexed subject requiring striking a fine balance with the competing demands of states.

New Delhi: Reserve Bank of India Governor Shaktikanta Das who is nearing the end of his second term, recently avoided a question about his future during a press interaction. When asked about it, he responded, “I am not giving you any headline and I think it is better we stick to monetary policy,” during his customary post-policy meeting with reporters at the central bank’s headquarters.

Das was responding to a question about whether the government had communicated anything regarding his continuation after his current term ends. Back in 2021, the government had extended his tenure just a month before it was set to expire.

A panel comprising Prime Minister Narendra Modi and Home Minister Amit Shah will be taking a call on appointing the next governor of the RBI. The career bureaucrat-turned-central banker’s term is ending on December 10. This is the second three-year-extension granted to Das and he is already one of the longest serving RBI governors in its 90-year history.

The RBI has opted for a status quo on rates for the 11th consecutive time on Friday, amid growing calls to address the slowdown in GDP growth in the July-September quarter at 5.4 per cent. On Friday, Das made it clear that the RBI has been acting as per the flexibility offered by the statutes to the central bank, making it clear that its effort is to keep the inflation horse on tight leash.

Das had assumed office at a very rocky time for the RBI, succeeding Urjit Patel who had decided to quit before the end of his tenure. Over the past six years, Das has dealt with a slew of challenges including Covid-19 and wars in Ukraine and Middle East. He has been awarded as the central banker of the year for two successive terms at global forums for his deft navigation of the fastest growing major economy in the world. (With PTI Inputs)

NEW DELHI: India’s foreign exchange reserves increased by $1.51 billion to $658.09 billion in the week ending November 29, the Reserve Bank of India (RBI) reported on Friday. This marks the first rise in nine weeks, recovering from a five-month low.

The reserves had previously declined by a cumulative $48.3 billion over eight consecutive weeks. In the prior week, they dropped by $1.31 billion, following a significant decrease of $17.76 billion earlier. The reserves had peaked at $704.88 billion at the end of September.

The latest rise is mainly due to a $2.06 billion increase in foreign currency assets, which now stand at $568.85 billion. These assets are influenced by exchange rate fluctuations of non-US currencies such as the euro, pound, and yen. However, the growth was partially offset by a $595 million decline in gold reserves, which now total $66.98 billion. Special Drawing Rights (SDRs) increased by $22 million to $18.01 billion, while India’s reserve position with the international monetary fund rose by $22 million to $4.25 billion.

The RBI uses foreign exchange reserves to manage market volatility and stabilize the rupee. Governor Shaktikanta Das stressed the importance of these reserves, saying, “Foreign exchange reserves are deployed judiciously to mitigate undue volatility, maintain market confidence, anchor expectations, and preserve overall financial stability.” He added that the reserve levels remain “quite robust.”

During the reporting week, the rupee weakened slightly against the dollar, closing at 84.69. This marked its fifth consecutive weekly decline and included a record low of 84.76 during the week.

Stay updated with live updates of the RBI’s Monetary Policy Committee (MPC) Meeting December 2024. Follow Governor Shaktikanta Das’s announcements on repo rate, interest rates, CPI inflation as well as GDP projections.

RBI Monetary Policy (MPC) Meeting Live Updates: RBI Governor Shaktikanta Das is set to announce the RBI MPC’s decision on the repo rate at 10 am today, Friday. Most analysts expect the status quo on the repo rate at 6.50% for the 11th time in a row. However, Nomura sees a 25-basis-point rate cut. Most analysts also feel that the RBI might cut CRR on Friday.

In the previous monetary policy in October, the RBI MPC had kept the repo rate unchanged at 6.5%. However, it had changed the monetary policy stance from ‘withdrawal of accommodation’ to ‘neutral’.

The repo rate is 6.50%, unchanged since February 2023. CRR remains at 4.5%, while the statutory liquidity ratio stands at 18 percent.

The repo rate is the interest rate at which the RBI lends money to banks to meet short-term needs. CRR is the percentage of a bank’s total deposits that must be kept in cash with the RBI, whereas SLR is the portion of a bank’s net demand and time liabilities (deposits) that must be held in the form of gold, cash, or government-approved securities.

The RBI is mandated to keep CPI inflation in the range of 2-6%. It uses repo rate, reverse repo rate, CRR, and other instruments to control inflation.

Currently, the RBI projects the CPI inflation at 4.5% for FY25. According to analysts, the central bank may have to revise it upwards to 4.8%, due to a recent spike in the inflation rate to 6.2% in October.

On the GDP growth front, the central bank had projected a 7.2% GDP growth for FY25. It is likely to be revised on Friday following the latest September 2024 quarter numbers that showed India’s GDP growth slowing to a seven-quarter low of 5.4%.

LIVE FEED

RBI MPC Meeting LIVE Updates: Will Governor Das get extension?

The December MPC meeting is particularly significant for RBI Governor Shaktikanta Das, as his term is set to conclude next week. With no official announcement on an extension yet, Das faces the challenging task of balancing slowing economic growth—potentially requiring a rate or CRR cut—with ongoing inflationary pressures that may necessitate keeping rates unchanged.

Reports suggest that Das is likely to receive an extension, with speculation pointing to a two-year term, though it remains unclear whether he will be granted a full three-year extension. As his second term comes to an end on December 12, all eyes are on how he handles this critical decision-making period.

RBI MPC Meeting LIVE Updates: What Does CRR Mean?

The Cash Reserve Ratio (CRR) is the proportion of a bank’s total deposits that it must hold as liquid cash with the Reserve Bank of India (RBI) as a reserve. The RBI periodically determines the CRR percentage, which is currently set at 4.5%. Banks do not earn any interest on the funds held under this requirement.

The CRR serves as a key tool for the RBI to control inflation and curb excessive lending, thereby maintaining financial stability in the economy.

RBI MPC Meeting LIVE Updates: How a CRR cut can boost lending and support growth

A 50 basis point (bps) reduction in the Cash Reserve Ratio (CRR) by the RBI could release between Rs 1.1 lakh crore and Rs 1.2 lakh crore for lending, while a smaller 25 bps cut would free up Rs 55,000 crore to Rs 60,000 crore. With more funds available to banks, this move could help stimulate economic growth.

A CRR cut can boost growth without stoking inflation, while also easing the challenges created by the RBI’s interventions in the foreign exchange market to manage the rupee’s depreciation. Experts also suggest that the RBI may explore additional measures, such as foreign exchange swaps and open market operations (OMOs), to further enhance liquidity.

RBI MPC Meeting LIVE Updates: Kotak anticipates CRR cut but no repo rate change

In its latest report, Kotak highlighted that the slowdown in GDP growth increases the chances of early policy actions. The firm anticipates a phased 50-basis-point CRR cut by the Reserve Bank of India (RBI) at the upcoming MPC meeting, which could inject Rs 1.2 lakh crore into the economy, signaling the start of a monetary easing cycle. However, Kotak Equities expects the RBI to maintain the repo rate at its current level, citing the persistently high inflation in October-November and global economic challenges.

RBI MPC Meeting LIVE Updates: ‘Markets have already factored in the likelihood of no rate cuts in December,’ says Anand Rathi

Narendra Solanki, Head of Fundamental Research at Anand Rathi, says, “Markets have already factored in the likelihood of no rate cuts in December. Attention will now turn to the Governor’s commentary.”

RBI MPC Meeting LIVE Updates: Market Expectations: Rate Cut or Market Stability?

Gaurav Garg, Research Analyst at Lemonn Market Desk, noted that while the market expects a rate cut, any deviation from this expectation could disrupt market momentum. He believes the RBI may prioritize economic stability over immediate market sentiments, opting to delay rate cuts until inflation aligns with its target.

RBI MPC Meeting LIVE Updates: Manoj Gaur, CMD of Gaur Group and President of CREDAI NCR, on Rate Cuts

Manoj Gaur emphasized that while a repo rate cut could provide relief to homebuyers, maintaining stability in the market is also important. He believes the RBI may signal a future rate cut, which would be beneficial for buyers, especially in the affordable housing segment.

RBI MPC Meeting Live Updates: What will happen to Sensex, Nifty if RBI Governor Shaktikanta Das doesn’t cut repo rate today?

Indian share markets are closely watching for a potential liquidity boost from the Reserve Bank of India’s (RBI) bi-monthly monetary policy announcement later today (Friday, December 6). While the Sensex and Nifty rose 1 percent on Thursday, investors are eager to see whether RBI Governor Shaktikanta Das and the Monetary Policy Committee (MPC) will implement a repo rate or cash reserve ratio (CRR) cut in light of signs of an economic slowdown.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, noted, “The rate cut cycle has begun in the US, though it has yet to start in India. The RBI will likely begin easing rates soon, even if not in today’s policy announcement. With potential rate cuts in the second half of the year, interest rate-sensitive sectors stand to benefit.”

Ajit Mishra, SVP-Research at Religare Broking, mentioned that markets are expecting liquidity measures but cautioned about a “knee-jerk reaction, especially in the banking sector, if the outcome differs from expectations.”

Kunal Rambhia, Fund Manager and Trading Strategist at The Streets, stated that dovish policy expectations are already factored into the market. “If the outcome is not as anticipated, we could see profit booking. The indices may not present a good risk-reward at these elevated levels, making a stock-specific approach more sensible,” he added.

RBI MPC Meeting Live Updates: RBI’s Inflation Task

The government has instructed the RBI to maintain the consumer price index (CPI) inflation at 4%, with a permissible variation of 2% above or below this target.

RBI MPC Meeting Live Updates: Real Estate Developers’ Expectations – Pradeep Aggarwal, Founder & Chairman of Signature Global

Any rate reduction could stimulate demand and strengthen the sector’s contribution to India’s economic growth.

RBI MPC Meeting Live Updates: Real Estate Developers’ Expectations – Mohit Kalia, Vice President of Raheja Developers

RBI MPC Meeting Live Updates: Real Estate Developers’ Expectations Ahead of the RBI MPC Decision

Real estate developers are anxiously awaiting the RBI’s decision, hoping for a rate cut or, at the very least, a more accommodative stance that could indicate a future reduction. With rising property prices and monthly mortgage payments increasingly squeezing homebuyers, many are hoping for relief.

RBI Policy Meeting Live Updates: How a CRR cut will impact Indian economy?

Suman Chowdhury, Executive Director and Chief Economist at Acuité Ratings, highlighted that the economic outlook is marked by uncertainty about growth and a cautious stance on inflation.

A CRR cut would infuse liquidity into the banking system, boosting economic activity without directly altering the repo rate. Chowdhury expects a high likelihood of a 50-basis point reduction in the CRR between December 2024 and February 2025, bringing it down from 4.5% to 4%.

RBI Monetary Policy Meeting Live Updates: D-Street momentum

India’s major equity indices surged for the fifth consecutive session on Thursday, rising nearly 1% driven by expectations of a CRR cut in Friday’s monetary policy review and short covering by foreign traders. The NSE Nifty gained 240.95 points (0.98%), reaching 24,708.4, while the BSE Sensex jumped 809.53 points (1%), closing at 81,765.86.

RBI Monetary Policy Meeting Live Updates: RBI Might Opt for CRR Cut Instead of Repo Rate Reduction

M Govind Rao, member of the 14th Finance Commission and former director of the National Institute of Public Finance and Policy, noted that the MPC faces the challenge of stimulating growth amid a slowing economy while managing inflation. He believes the RBI may maintain the current repo rate but could consider a marginal reduction in the Cash Reserve Ratio (CRR) to ensure adequate liquidity.

RBI Monetary Policy Meeting Live Updates: Recap of the October 2024 RBI MPC Meeting – Key Highlights & Outcomes

- Repo rate kept unchanged at 6.5%.

- The RBI has maintained this rate since February 2023.

- The monetary policy stance was shifted to ‘neutral’.

- GDP growth forecast for FY25 remained at 7.2%.

- Inflation projection for FY25 retained at 4.5%.

- UPI123PAY (for feature phones) transaction limit doubled to Rs 10,000.

- UPI Lite wallet limit increased to Rs 5,000, with a per-transaction limit raised to Rs 1,000.

RBI MPC Meeting Live Updates: Meet the MPC members

The Monetary Policy Committee (MPC), led by RBI Governor Shaktikanta Das, consists of three external members who serve a four-year term, with their appointments made by the central government. Recently, the government appointed three new external members to the committee: Saugata Bhattacharya, Economist; Dr. Nagesh Kumar, Director and Chief Executive of the Institute for Studies in Industrial Development; and Professor Ram Singh, Director of the Delhi School of Economics, University of Delhi.

The internal members of the MPC include Shaktikanta Das as the Chairperson, Michael Debabrata Patra, RBI Deputy Governor in charge of monetary policy, and Rajiv Ranjan, Executive Director of the RBI’s Monetary Policy Department.

RBI MPC LIVE Updates: What Happens to Your Home Loan Rates If RBI Keeps the Repo Rate Unchanged for the 11th Consecutive Time?

The Reserve Bank of India’s (RBI) repo rate plays a crucial role in determining home loan rates. Homebuyers eagerly await the RBI’s upcoming decision, as it will directly impact loan interest rates, including those for home loans in India.

When the RBI raises the repo rate, banks generally increase their lending rates, resulting in higher home loan interest rates (both fixed and floating). Conversely, a decrease in the repo rate leads to lower lending rates, making home loans more affordable. Borrowers with floating interest rates will feel the effect immediately or at their next rate reset.

For homeowners or those paying Equated Monthly Installments (EMIs), a stable repo rate means their interest rates will remain unchanged for now.

RBI Monetary Policy 2024 Live: Buzz Surrounding the New RBI Governor

The policy press conference is likely to be filled with questions about whether Governor Das will receive an extension or who his successor might be, if no clarity is provided before Friday. His term is set to end on December 10, 2024. When Das was last extended in 2021, the government had announced it over a month in advance.

RBI Monetary Policy 2024 Live: Analysts Expect CRR Cut

To ease liquidity, analysts anticipate that the RBI may reduce the Cash Reserve Ratio (CRR), the portion of deposits that banks are required to hold as reserves with the central bank. Upasna Bhardwaj, an economist at Kotak Mahindra Bank Ltd., stated that a CRR cut would serve as a soft signal for an upcoming monetary easing cycle.

RBI Monetary Policy December 2024 Live: Additional Liquidity Measures Expected

Economists also expect the RBI to introduce measures to address liquidity concerns. Recent capital outflows and pressure on the rupee have added complexity to the policy outlook. The rupee has hit new lows, and any easing of monetary policy could further weaken the currency by reducing the interest rate differential with the US.

Tight liquidity conditions have resulted from the central bank’s large forex interventions and currency outflows from the banking system. According to ICICI Securities Primary Dealership, the core banking system liquidity surplus has dropped to Rs 1.2 trillion, down from Rs 4.5 trillion at the end of September.

RBI Monetary Policy December 2024 Live: More MPC Members May Vote for a Rate Cut

In the October meeting, external member Nagesh Kumar voted in favor of a 25 basis point rate cut. With increasing calls for a reduction in interest rates, more MPC members may join him in supporting a rate cut. Madhavi Arora, an economist at Emkay Financial Services Ltd., anticipates that at least two members may vote for lowering the key rate to support growth.

RBI Monetary Policy December 2024 Live: Growth-Inflation Divergence Poses a Dilemma for the RBI MPC

The RBI faces a tricky dilemma with the ongoing divergence between growth and inflation. Volatile food prices pushed headline inflation to 6.2% in October, the fastest pace in over a year. According to Radhika Rao, an economist at DBS Bank, this growth-inflation divergence will create a difficult decision for the RBI MPC. She expects the RBI to lower its full-year growth projection by 30-40 basis points and revise its inflation forecast upwards from the current 4.5%.

RBI MPC LIVE Updates: Das & Co. May Lower GDP Forecast

The central bank’s growth forecast of 7.2% for the fiscal year through March 2025 is now at risk after the 160-basis point miss in the second-quarter GDP figures. Economists, including those from Goldman Sachs, have revised their growth projections downward, with Goldman now predicting a 6% expansion, down from a previous estimate of 6.4%.

RBI Monetary Policy December 2024 Live: A Shift in the MPC’s Policy Narrative is Inevitable

“We believe a shift in the MPC’s policy narrative is inevitable, starting with acknowledging the growth slowdown and the need for counter-cyclical support,” said Teresa John, an economist at Nirmal Bang Institutional Equities Ltd., to Bloomberg. While the RBI may hold off on rate cuts until next year, she noted that a surprise move cannot be entirely ruled out.

RBI Monetary Policy Meet December 2024: Inflation & Growth Remain Key Challenges for Shaktikanta Das

Finance Minister Nirmala Sitharaman and Commerce Minister Piyush Goyal have both called for lower borrowing costs in recent months. Some economists are urging the RBI to take further action to stimulate lending and drive growth. Governor Das is under pressure to tackle both inflation and growth challenges, with his six-year term set to end next week, and no clear indication of an extension.

RBI Monetary Policy Meet December 2024: Rate Cut Unlikely

Governor Shaktikanta Das has repeatedly ruled out an immediate rate cut, despite the RBI adopting a neutral stance in its October meeting. Inflation continues to remain above the RBI’s 4% target. However, the weaker-than-expected GDP growth of 5.4% for the July-September period is raising concerns that the RBI’s restrictive policies may be impacting economic activity.

RBI Monetary Policy Meet December 2024: RBI Kept Its Policy Rates Unchanged Over The Last Ten Meetings

Over the last ten meetings, the RBI has kept its policy rates unchanged at 6.5%. The central bank has taken a more hawkish stance on inflation, primarily due to persistent food price inflation that has not been effectively contained. At the same time, it remains optimistic about growth, driven by favorable monsoon rains and expectations of a revival in capital expenditure.

RBI Monetary Policy Meet December 2024: Shaktikanta Das To Announce Repo Rate Decision Today

The RBI is set to announce its interest rate decision today, as the country grapples with high inflation and sluggish GDP growth. Stay tuned for the latest updates and detailed analysis on India’s economic outlook.

Last Updated:

If reappointed, Das will become the second RBI governor to have his term extended twice.

It is not yet clear whether Shaktikanta Das will receive a full three-year term or a shorter extension.

Governor Shaktikanta Das is expected to continue in his position once his current term ends in December. Das, who has effectively managed the sensitive role, is seen as a strong candidate for an extension.

According to a report by Moneycontrol, people familiar with the situation confirmed that the Ministry of Finance has already recommended Shaktikanta Das’ reappointment to the Appointments Committee of Cabinet (ACC), and a final decision is expected soon.

“It is anticipated that he would continue office for two more years after his current term ends on December 12,” a person with knowledge of the matter told Moneycontrol.

Uncertainty Over Extension Tenure

It is not yet clear whether Das will receive a full three-year term or a shorter extension. However, sources suggest that he may continue in office for another two years beyond his current tenure, which concludes on December 12.

Reports Indicate Continued Tenure

Reuters first reported on November 18 that Das is likely to remain as governor.

Delay Due to Election Code of Conduct

The delay in the reappointment process is partly attributed to the code of conduct in place for state elections in Maharashtra and Jharkhand, which may have postponed the official announcement.

Das Set to Become One of the Longest-Serving RBI Governors

If reappointed, Das will become the second RBI governor to have his term extended twice. Should his tenure extend beyond one year, he will join the ranks of the longest-serving RBI governors in history.

Leadership Recognition

Das succeeded Urjit Patel as RBI Governor on December 12, 2018, and was reappointed for a second term in December 2021. He was recently named the top central banker by Global Finance for the second consecutive year in 2024, with an A+ rating for his leadership in guiding the RBI through challenging economic times.

RBI Governor Shaktikanta Das Hospitalised

Shaktikanta Das was hospitalised in Chennai on November 25 due to issues related to ‘acidity,’ and is now doing fine.

Das was admitted to Apollo Hospital for observation.

“He is now doing fine and there is no cause of concern. He will be discharged shortly,” a medical bulletin issued by Dr R K Venkatasalam, Director Medical Services, Apollo Hospitals, said.

Meanwhile, a RBI spokesperson said, “Das experienced acidity and was admitted to Apollo Hospital, Chennai for observation.” “There is no cause for concern”, the spokesperson added.

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das has said that the Indian economy is strong enough to handle any adverse fallout from global events. “Today, the growth of the Indian economy presents a picture of stability and strength,” Das said while addressing an event at the launch of the Kochi International Foundation here.

The country’s external sector is also strong and the current account deficit (CAD) has remained within manageable limits as it presently stands at 1.1 per cent of GDP. Earlier, in 2010 and 2011, it was in the range of six to seven per cent, he added.

The central bank chief also pointed out that India has one of the largest foreign exchange reserves in the world at about $675 billion. He further stated that the country’s inflation was expected to be moderate despite periodic humps.

India’s inflation rose to 6.2 per cent in October from 5.5 per cent in September because of food inflation, he said. Referring to inflation as an elephant in the room, Das remarked: “Now the elephant has gone out of the room for a walk, then it will go back to the forest.”

He also pointed out that when the Ukraine war started, inflation went up but the RBI followed the right monetary policy, unlike some other countries, and succeeded in keeping the price spiral in check.

“What we did not do in India is also important. RBI did not print notes because if we start printing notes the problems we are trying to resolve will expand and go beyond handling. In many countries the inflation was deep-rooted but ours is moderating,” he added.

“We kept our interest rate 4 per cent, therefore making our recovery much easier,” he pointed out. Das also highlighted how the RBI is bringing about a transformational change in credit delivery, especially to small entrepreneurs and farmers, through the Unified Payments Interface (UPI) and the Unified Lending Interface (ULI) launched recently.

India’s central bank governor Shaktikanta Das said an interest rate cut at this stage would be “very, very risky” and he’s in no hurry to join the wave of easing by global policymakers.

While inflation is expected to moderate, there are “significant risks” to the outlook, Das told Bloomberg News Deputy Editor-in-Chief Reto Gregori at the India Credit Forum in Mumbai on Friday.Inflation and growth dynamics are well balanced, he said, but policymakers need to remain vigilant about price pressures.

The Reserve Bank of India has kept its key interest rate unchanged for almost two years, although signaled last week it may be preparing to ease after changing its policy stance to neutral. That comes as central banks around the world follow the US Federal Reserve in reducing interest rates, with Thailand the latest to surprise with a cut this week.

Responding to a question about global central bank easing, Das said “we will not miss the party, we don’t want to join any party.”

Indian bonds extended losses after his comments, with the 10-year yields rising as much as 4 basis points — the most in two weeks — to 6.82%.

Das pushed back against some analyst views that the RBI was “behind the curve” in cutting rates. Market expectations were aligned with the central bank actions, he said, citing last week’s policy decision that was predicted by most economists.

“The governor’s comments show rate cuts may not happen before February, or it may get even delayed if actual inflation does not align with the target,” said Gaurav Kapur, chief economist at IndusInd Bank Ltd. “Given the comfort on growth, the monetary policy committee can continue to focus on price stability.”

Das’s comments on Friday were his first public reaction since data this week showed inflation accelerated more than expected in September. Das said October’s inflation rate will remain elevated before moderating in November.

That’s made the timing of a rate cut uncertain, with several economists pushing out their rate-cut forecasts from December to next year.

“A rate cut at this stage can be very premature and can be very, very risky,” Das, 67, said. “When your inflation is 5.5% and your next print is also expected to be high, you can’t be cutting rate at that stage.”

Not joining the party

Das has repeatedly said the RBI wants to see inflation settling around the 4% target level on a durable basis before considering a cut. Deputy Governor Michael Patra has indicated that won’t happen until the fiscal year that starts April 1.

“We would rather like to wait and watch,” Das said. “If we want to join the party we want to do it on a durable basis. When we have confidence, inflation figure is durably aligned with our target 4% that may be a situation where we can think of” easing, he added.

Future monetary policy action will depend on incoming data as well as the inflation outlook for the next six months to a year, the governor said.

Das’s relatively hawkish comments come against the backdrop of recent evidence showing India’s world-beating growth is starting to taper off and company profits are weakening.

The RBI is more bullish about growth prospects, though, compared with the market consensus and even the government. Das last week kept the central bank’s forecast for the current fiscal year unchanged at 7.2%, while the government’s own projection is a more subdued 6.5%-7%.

On the currency, the governor on Friday reiterated the RBI isn’t trying to manage the exchange rate and the rupee has been depreciating in response to the overall movement of the dollar.

The RBI is building its foreign exchange reserves as a “safety net” to protect against any instability from volatile capital flows, he said. The central bank has no specific target for building reserves, he added.

India’s foreign exchange reserves are the world’s fourth largest, recently crossing the $700 billion mark as the RBI soaks up dollar inflows to keep the rupee stable.

Contract extension

A long-time bureaucrat, Das, took the helm at the central bank in December 2018 after his predecessor Urjit Patel resigned unexpectedly. Das’s second term contract comes to an end in December this year, and neither the government nor Das have given any indication whether he will remain in the post after that.

Asked about his future, Das was typically coy, saying he’s preoccupied with his current work at the RBI and hasn’t given any thought about whether he’ll stay on in the position if he’s offered another extension.

“At the moment, that is certainly not in my mind,” he said. The central bank must finalize a few draft guidelines, and announce an interest rate decision before Das’s current term comes to an end in early December.

“Already my table is full, so I have no time to really think of what next,” he said. “We will see.”

NEW DELHI: The Reserve Bank of India’s (RBI) governor Shaktikanta Das on Friday said that interest rate cut at this stage will be ‘premature, and very, very risky’.

Speaking at the fireside chat at the India Credit Forum event in Mumbai by Bloomberg, governor Das warned against any premature interest rate cuts when inflation risk is still there. RBI still maintains a growth forecast of 7.2 per cent for FY25 and expecting the inflation to moderate by November.

“We are not behind the curve. Indian growth story remains intact. India is poised to grow at 7.2 per cent. Growth is steady and resilient, inflation is moderating with certain risk, so a rate cut at this point will be premature and very, very risky,” Das said

While inflation is expected to moderate, Governor Das also said that there are ‘significant risks’ to the growth outlook.

During the October monetary policy announcement, RBI had maintained the status quo on rate and changed stance to ‘Neutral’ from ‘Withdrawal of Accommodation.’

“There can be differences of opinion, but the broad expectations of the market are quite aligned with our policies,” he said, countering criticisms that the RBI may be behind the curve in managing the economic outlook.

He further elaborated on India’s overall economic resilience, highlighting the country’s stable macroeconomic fundamentals and strong confidence from international investors. According to Das, these factors have helped maintain the stability of the Indian rupee, which has depreciated only modestly in response to global market movements.

He assured that while private credit poses global risks, India’s regulatory framework for non-banking financial companies (NBFCs) ensures stability.

Das’s remarks come amid broader discussions about India’s economic momentum, with the nation recently overtaking China in population and maintaining a faster economic growth rate than its neighbour.

He emphasized that India’s growth story remains intact, even as the country navigates inflationary pressures and global economic challenges.

Answering to the question on Private credit, the RBI governor further said that it is posing certain risks to every central bank but there is no danger for India.

“So far as India is concerned, it’s not a problem at the moment in the sense that private credit in the Indian context is mostly offered by the non-banking financial companies which are regulated by the reserve bank,” he added.

Reflecting on the RBI’s contributions over the past few years, Das highlighted several key initiatives that have strengthened India’s financial sector.

He pointed to the RBI’s proactive stance in regulating the banking sector, stating that the RBI is maintaining a close vigil over the credit markets and taking action whenever necessary.

The governor underscored the RBI’s role in enhancing the stability of banks, reducing the gap between credit and deposit growth, and supporting the rapid rise of non-banking financial companies (NBFCs), which now account for roughly 30 per cent of India’s credit market.

Pointing out regarding KYC issues, Das said, “I think there are some complaints about KYC related issues, know your customer related issues and knowing the, you know, knowing the ultimate, the beneficial ownership of investments. Now, this is not something which is our creation, but this is a FATF requirement.”

KYC norms are essential for ensuring that funds entering India are from legitimate sources, given the complexities of global financial markets.

“We get often representations about issues relating to procedural issues, relating to know your customer. That is the KYC-related issues. And that is being addressed not just by us, but also by the securities market regulator, particularly for foreign portfolio investors. It’s more to do with the securities market regulator, the SEBI, which is dealing with it,” he added.