Market Analyst Questions Efficacy of STT Hike on F&O Trading, Highlights Structural Imbalances

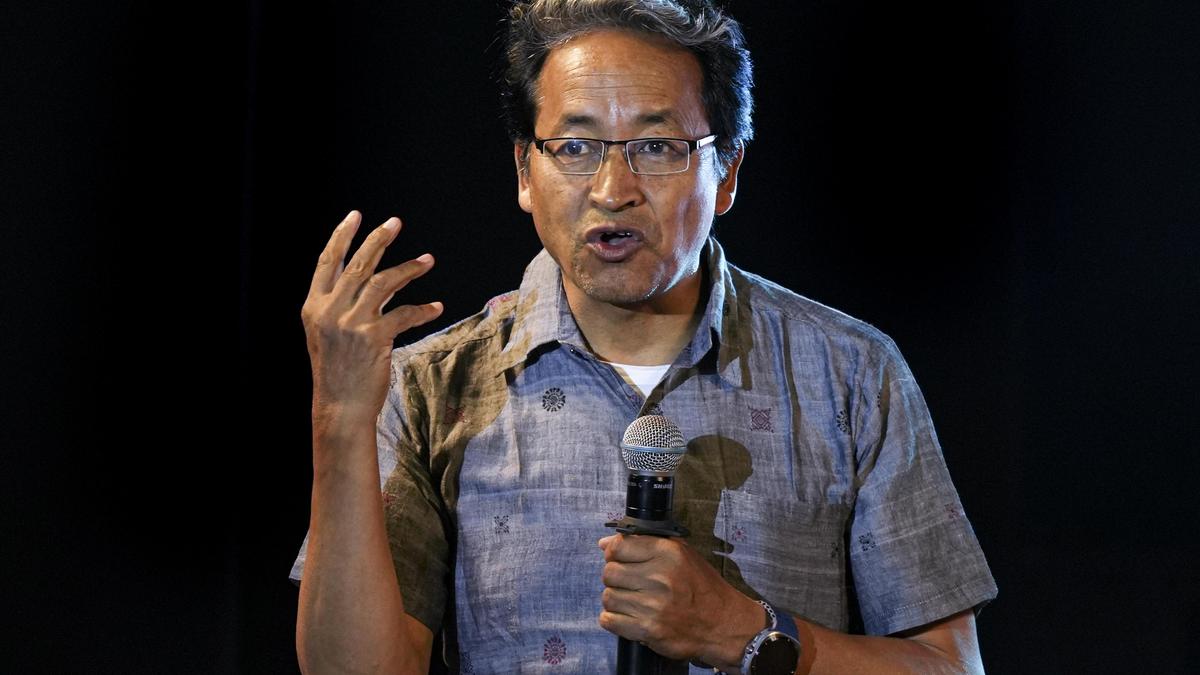

In a critical assessment of recent fiscal policy adjustments, market experts are scrutinizing the rationale behind the Securities Transaction Tax (STT) increase on Futures and Options (F&O) trading. Nithin Kamath, co-founder of Zerodha, has publicly questioned the effectiveness of this measure, suggesting it may fail to achieve its intended objectives. Kamath notes that the tax hike disproportionately impacts futures trading, which constitutes a smaller segment of the market, while leaving options—accounting for approximately 95% of F&O transactions—largely unaffected. This discrepancy raises concerns about the policy's alignment with market realities, as options are generally considered more speculative than futures. The analysis points to potential structural flaws in the tax framework, which could undermine its ability to curb speculative trading or generate meaningful revenue. Such insights highlight the need for a more nuanced approach to financial regulation, one that considers the distinct characteristics of different trading instruments. As policymakers evaluate the impact of these changes, the debate underscores broader questions about balancing fiscal objectives with market efficiency and investor protection.