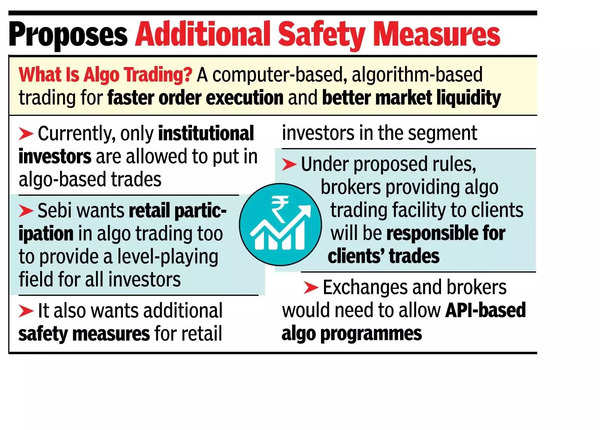

MUMBAI: Markets regulator Sebi plans to allow retail investors access to algo-based trading. Currently, only institutional investors are allowed to put in computer or algorithm-based trading, popularly called algo trading. According to market players, this could provide a level-playing field for institutional and non-institutional investors in the trading space.

On Friday, Sebi floated a draft circular to allow retail investors to algo trade. It has proposed several checks & balances for the brokers through whom investors would be allowed to place algo-based orders. It also suggested having a system at the exchange level that would allow the bourses to cancel algo orders that do not adhere to rules, without disrupting the overall market.

A recent Sebi study on derivatives trading showed that in FY24, around 97% of foreign funds’ profits and 96% of proprietary traders’ profits were generated from algo trading, Ajay Garg, director & CEO at SMC Global Securities, said. “The proposed refined framework of algo trading will build the trust of retail investors and help them generate higher profits, given that it benefited FPIs and institutional investors in the past.”

Sebi is now proposing additional safeguards to the existing regulatory framework to extend algo trading to retail investors too. “The evolving nature of algo trading – particularly with the increasing demand for algo trading by retail investors – has necessitated a further review and refinement of the regulatory framework so that retail investors are also able to participate in algo trading with proper checks and balances,” the markets regulator said.

Sebi also proposes to spell out the rights and responsibilities of the investors, stock brokers, algo providers/vendors and market infrastructure institutions (MIIs) so that the retail investors in the space have adequate safeguards. It put forth that retail investors will get access to the approved algos only from the registered brokers. This presents better opportunities for stockbrokers to expand their customer base in a regulated environment, Garg said.

In its draft circular, Sebi said that a stock broker would be allowed to provide an algo trading facility only after it obtains permission from stock exchanges for each algo. Also, all algo orders will be tagged with a unique identifier provided by the stock exchange so that an audit trail is established.