JAISALMER: With several states still not on board to waive goods and services tax (GST) on term insurance and slash the rate from 18% to 5% on health insurance, the all powerful GST Council may have to defer a call on the issue, which is of tremendous interest to the middle class.

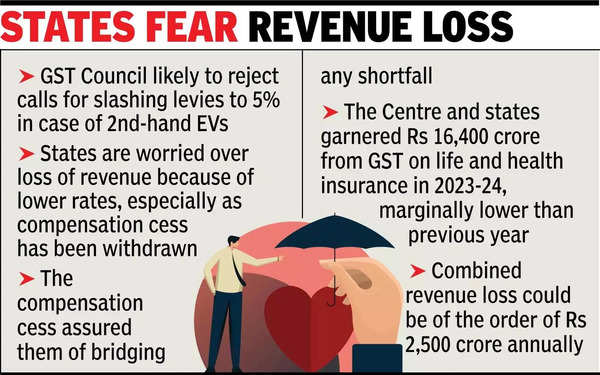

It is, however, likely to increase the levy on second-hand vehicles from 12% to 18%, dismissing calls for slashing levies to 5% in case of second hand electric vehicles.

While there is no consensus on reworking rates, given the concerns expressed by states, such as West Bengal, Kerala and Karnataka, even insurance has failed to get the necessary support, as was widely expected. The task of reworking rates was assigned to a group of ministers (GoM) led by Bihar deputy chief minister Samrat Chaudhary.

It will take a massive effort on part of the Centre on Saturday to get the states to agree to the tax changes on insurance proposed by another GoM, which also has Chaudhary as the convenor.

States are worried that they will lose revenue because of the lower rates, especially as the compensation cess has been withdrawn, which assured them of covering any gaps. The Centre and states raked in Rs 16,400 crore from GST on life and health insurance in 2023-24, marginally lower than the previous year. The combined revenue loss could be of the order of Rs 2,500 crore annually.

Besides, it is unclear how the GST Council intends to enforce that the benefit of lower taxes is passed on to consumers, given that the anti-profiteering clause has now been dispensed with. Finance minister Nirmala Sitharaman had recently indicated that market forces will take care of the issue.

Even on the issue of rationalisation of rates for 148 items, which was discussed by the ministerial panel, states have their concerns. On the agenda will be issues related to taxation of food delivery services, a cut in the tax on cancer therapy and clarification on sponsorships and FSI.