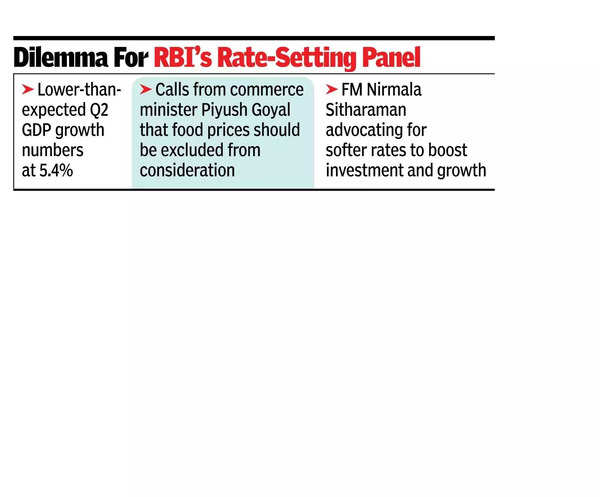

MUMBAI: Despite growth numbers coming in sharply lower and all-round calls for reduction in interest rates to support growth, the monetary policy committee (MPC) will find reducing rates a challenge.

Lower-than-expected Q2 GDP growth numbers at 5.4% have increased pressure on RBI‘s MPC to reduce interest rates even as the expectation of a softer policy led to bond yields falling on Friday.

The rate-setting panel has also faced pressure from govt, with commerce minister Piyush Goyal suggesting that food prices should be excluded from consideration and finance minister Nirmala Sitharaman advocating for softer rates to boost investment and growth.

But while monetary policy cannot impact the prices of tomatoes, onion or potatoes, it can reduce demand and bring down overall prices which will soften headline inflation.

According to Shreya Sodhani, economist with Barclays, RBI is expected to keep policy rates unchanged this week despite weaker growth, ‘according primacy to price stability’. “We highlighted that a weaker-than-expected Q3 GDP print may prompt the MPC to ease monetary policy, but the timing would depend on the outlook of growth and inflation,” Sodhani said in a report.

In the MPC meeting in Oct, of the three newly inducted external members, Nagesh Kumar was the only one who called for an immediate 25 basis point rate cut. Earlier in Aug, outgoing members Jayanth Varma and Ashima Goyal had voted for a rate cut. Varma was strident in advocating for lower rates and had said that the status quo in rates undermines India’s growth potential.

“The outlook for H2 FY25 is decidedly mixed. We foresee a likely improvement in rural demand owing to the robust growth in kharif foodgrain output and upbeat outlook for rabi crops amid replenished reservoir levels, as well as expectations of a back-ended pick up in govt capex,” Aditi Nayar, chief economist with Icra, said. But in light of the spike in inflation, Icra expects the MPC to cut rates in Feb at the earliest if inflation recedes.While not many expect RBI to cut the repo rate there is an expectation that it will take measures to ease liquidity and bring down interest rates in the money market.