Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it’s investigating the financials of Elon Musk’s pro-Trump PAC or producing our latest documentary, ‘The A Word’, which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.

Car makers are stepping up their campaign calling for government help for themselves and their buyers.

The government plans to water down demands for car makers to make a percentage of their cars battery-powered after slow sales and after Vauxhall’s owner Stellantis said it would shut down a plant in Luton because of the rules.

At least 22 per cent of cars made in British factories must be battery-powered, and a tenth of vans. Breaking the rules means either buying credits from competitors who are beating these targets – an unpopular option – or paying a fine of £15,000 per car.

But lower fines could be agreed upon to give manufacturers and customers more time to make the switch.

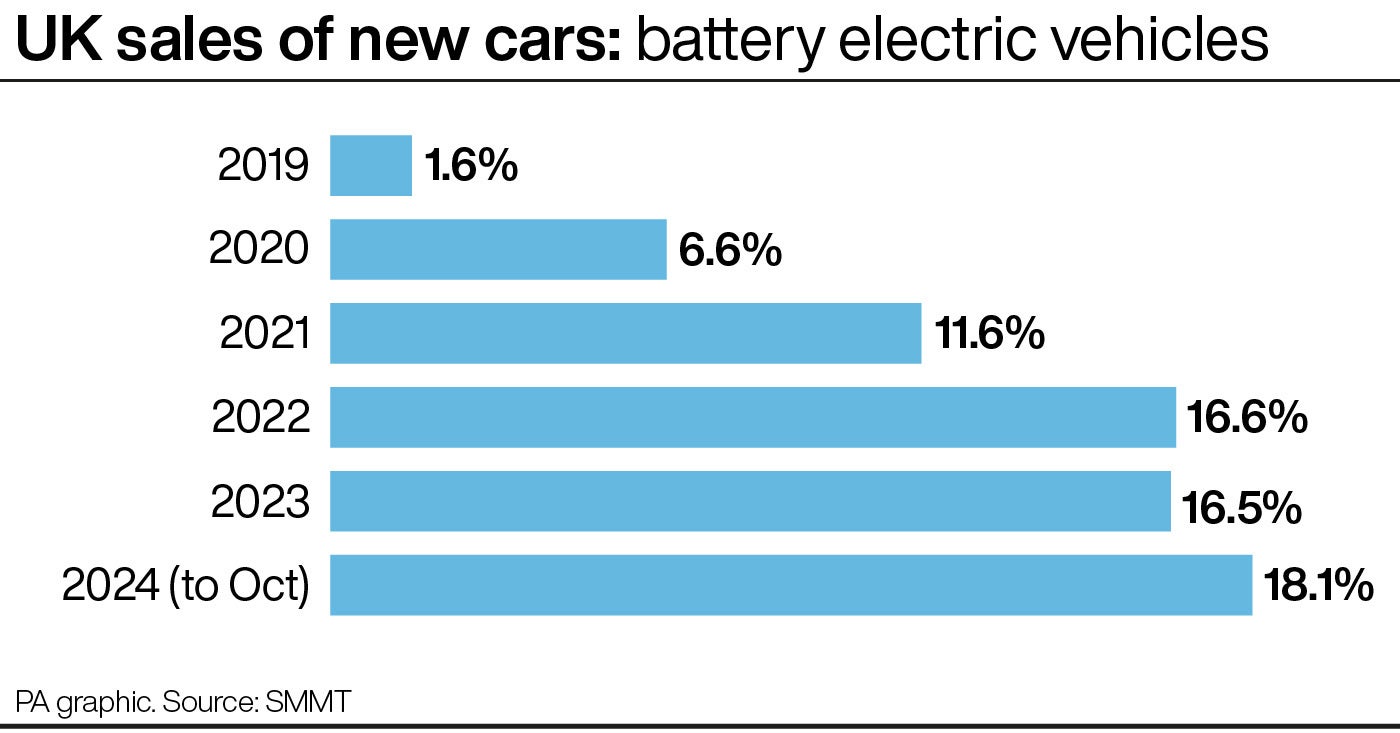

It comes as manufacturers worry about slow pickup of the vehicles which are pricier than petrol models but cheaper to run.

The price gap is slowly declining, but a cost of living crisis, low wage growth and higher borrowing costs are putting pressure on buyers.

Ford announced 800 job cuts in the UK this month and other firms have warned about job cuts and cutbacks if the slow take-up continues.

There are generous incentives for some electric car buyers. However, as you will see below, they are not as generous as they once were, and the government’s largesse is not distributed evenly.

Tax help now

The biggest help comes for corporate buyers, which means you will need to get your employer to buy you an electric car as a perk.

This should be possible for those who need a car to do their job – for instance, those in sales who go to clients to conduct business. Needing a car to commute may not be enough of a reason.

Businesses which buy company electric cars get a capital allowance, meaning the cost of the vehicle can be set against its corporation tax bill. This does not work if the car is hired.

Employees who get to use a company car and keep it for personal use will also get a tax benefit.

Getting a company car is seen by the government as a benefit in kind and is taxable. Electric cars are rated at just 2 per cent of their value per year, compared to up to 37 per cent for combustion engine vehicles, and that amount is then multiplied by a person’s tax band.

For instance, a company car user with an electric car worth £35,700 with a benefit in-kind rate of 2 per cent and an income tax band of 20 per cent will pay just £142.80 a year in tax to use their EV.

A petrol car of the same price would cost £2,550, a diesel £2,641.80 and a hybrid car £856.90, according to energy firm Octopus.

That 2 per cent rate will increase each year, becoming 9 per cent in 2029, but still far below 19 per cent for hybrid cars and up to 39 per cent for combustion models.

As can be seen, these generous allowances are best for those who work for firms with a company car scheme or who run a limited company.

If you don’t, what’s on offer is far more limited.

The car industry is lobbying the government hard to expand help for those who do not have access to a car as a job perk.

Tax help available now which is being abolished

Until April 2025, electric cars will pay no road tax. Beyond that date, they will be taxed the same as petrol and diesel cars, albeit at a cheaper rate.

EVs registered from April will pay £10 road tax for the first year.

However, the £410 surcharge that cars worth more than £40,000 have to pay for five years is waived for electric cars, and will continue to be.

Electric cars are also exempt from the congestion charge in London, although that perk will also end in 2025.

Other available help includes a £350 changepoint grant for renters and flat owners, which will operate until March

Tax help in the future

If EVs continue to be sold at a slow pace, the government may decide to help, since EV take-up is central to Britian’s decarbonising plans.

Halving VAT on electric cars to 10 per cent could aid in persuading more drivers to make the switch, the industry’s mouthpiece the Society of Motor Manufacturers and Traders has said.

Help which has already been abolished

Two years ago the government ended its popular £300m grant scheme, which offered a £1,500 discount on electric cars worth less than £32,000. About half a million buyers had been helped by the scheme.