Hannah Clarke

Hannah ClarkeThe Budget on Wednesday will reveal how much tax each of us will pay and how much the government will choose to spend on services like the NHS, schools and transport.

BBC News has been speaking to people with a range of incomes about what they want from the Budget and, in some cases, how they fear they could be impacted.

If there are issues you would like to see covered, you can get in touch via Your Voice, Your BBC News.

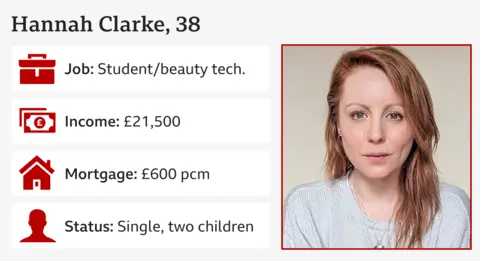

Hannah Clarke

Hannah ClarkeMum-of-two Hannah Clarke from Rutland in the East Midlands was juggling two part-time jobs but recently started studying full-time for a midwifery degree. She also works six to eight hours a week as a beauty technician.

She takes home about £1,800 a month, mostly via a student loan which she doesn’t pay tax on. She says this just about covers her mortgage payments – which went up by a third earlier this year – bills and fuel.

“I just about make ends meet, but it isn’t easy and I do sometimes have to ask for help,” she says.

She would like free school meals to not be means tested but failing that, says the eligibility threshold should be lowered. She also says if fuel duty goes up then the extra cost per litre of petrol or diesel “should absolutely not be passed on to drivers”.

‘I can’t move out on £1,500 a month’

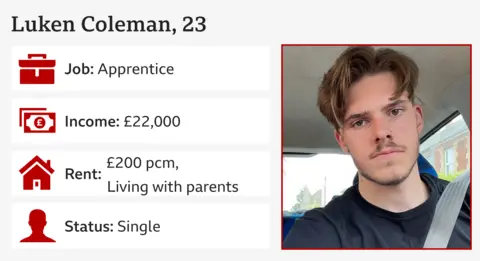

Luken Coleman works as a Level 3 business administration apprentice for a recruitment agency, earning about £1,500 a month. Previously he worked in shops and in manual labour jobs.

He works full-time Monday to Friday and goes to college one day a month.

Luken lives in Newbury with his parents and pays them £200 a month rent. While he pays all his own bills, he cannot afford to move out and says he would like to see apprentices get paid more.

“The average rent where I live is between £700 to £900 per month. If I did move out, I’d have to move further away, so I’d need a car.”

As someone nearing his mid-20s, he says it can feel like you’re not achieving much when you are still living at home.

“It’s a mental health thing. Money-wise, apprentices are paid less because you are learning on the job, but it can make you feel less about yourself when you are not fully independent.”

‘I make £7,600 a month but £2,600 goes on childcare’

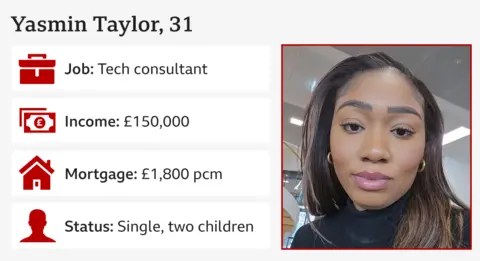

Yasmin Taylor from Kent is a tech consultant and single mother of two young children.

Her biggest outgoing is £2,600 per month on childcare. The children’s father also helps with costs.

“I studied and worked hard to get a job that pays a great salary, but I feel like I’m being punished for having children,” she says.

Because of her £150,000 salary, Yasmin does not qualify for Child Benefit payments, or help via tax-free childcare or 30 hours free childcare.

She acknowledges that her income classifies her as a high earner, but says: “You still have to pay the gas and the electric and that’s gone up a lot.”

One of her main concerns is around energy bills this winter.

She is also interested in what the chancellor may do on capital gains tax (CGT). Although she is not subject to CGT now, the next step in her career would be to become a partner at her firm, which would involve her buying shares in the company – which may later be subject to CGT if she were to sell them.

‘I can only afford a caravan on £1,590 a month’

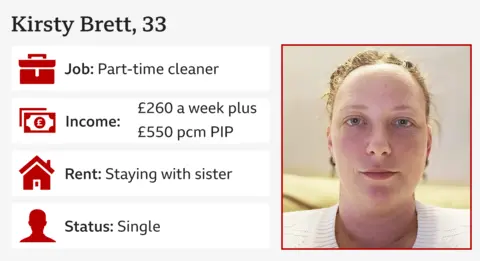

Kirsty Brett works part-time as a cleaner in a care home, earning the minimum wage of £11.44 an hour.

She recently moved in with her sister in Bury St Edmunds in Suffolk while she looks for new accommodation, after leaving her old job as a carer in Essex.

Kirsty has osteoporosis, which made her work difficult, and also found it too expensive living in Essex. She receives £550 a month in Personal Independent Payments.

She would like to see a rise in the National Living Wage.

“People should be paid at least £15 an hour. Because the cost of living has gone up. That would help a lot of people.

“The wage they class as minimum wage – I don’t see how it sustains someone.”

She is now looking at “the cheapest options” for somewhere to live. She says she’s found renting a one-bedroom flat costs about £1,300 a month, so Kirsty is instead looking at renting a caravan for around £800 a month.

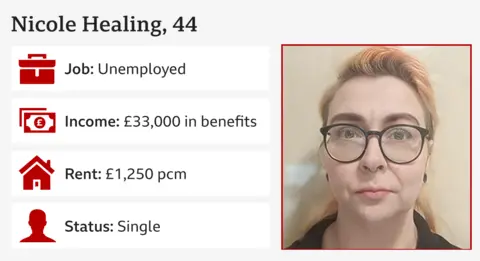

‘I get £2,750 in benefits and I’m freaking out over cuts’

Nicole Healing rents a one-bed flat in Brighton for £1,250 a month.

Nicole previously worked as a civil servant and in digital marketing, but hasn’t been able to work for the last few years due to several disabilities, including a connective tissue disorder that causes their joints to dislocate.

Nicole receives Employment and Support Allowance of £1,042, Personal Independent Payments of £798, and Housing Benefit of £917 per month.

Though they feel in a “fortunate position” currently, Nicole says: “I feel I am at the mercy of the DWP.”

Nicole is “completely freaking out” about possible cuts to benefits in the Budget and what that could mean for them.

“I am fearful about the negative rhetoric in the media about disabled people in receipt of benefits.”

They say their energy bill has gone up significantly in the last few years and they are worried their rent will also increase.

“I am not able to use my PIP for what it’s meant to be used for. Half of the payment goes towards my rent.”

Nicole wants the Budget to clarify what support is planned for disabled people, and is hoping for a cap on energy bills this winter.

‘I try to save as much of my £1,920 a month as I can’

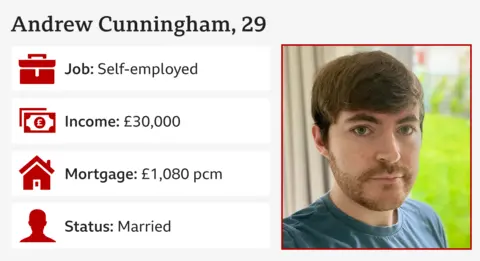

Blogger and web developer Andrew Cunningham lives with his husband in Glasgow. He describes themselves as “middle earners but diligent savers” who have been investing in their individual savings accounts (ISAs) and their pensions to fund their retirement.

He is concerned about rumours that there might be a cap on the amount of money you can hold tax-free in an ISA in the Budget. “That would hit us and would be a massive disincentive to save.”

He is also worried that any flat rate introduced on pension tax relief would hit middle earners.

As he is self-employed, Andrew has set up a self-invested personal pension. A single rate tax relief would mean less money going into his pension.

“We are living our lives assuming we won’t get a state pension when we get to pension age, at least not in the form it is now,” he says, pointing out that spending on the state pension has grown over the years as a percentage of the government’s budget.

He thinks in years to come, the government might have to raise the state pension age again, or cut the amount of benefit you get.

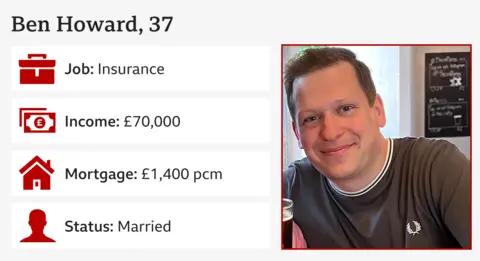

‘We earn £100,000 and expect to be worse off’

Ben Howard and his wife Sarah from Bristol are expecting their first child in February. They have a joint income of £100,000. In September, their mortgage repayments went up by 60% to £1,400.

Ben says they’re “comfortable”, but thinks the government should do more around the cost of childcare, because in some cases, “it’s more efficient for [parents] not to work”.

“But that puts us back in terms of what our career aspirations are.”

Ben is not fully convinced that Labour will keep their promise of not raising taxes on working people. “Am I going to see tax on my pension contributions, any kind of stealth tax?”

He expects to be worse off after Budget day. “They’re going very big on business and growing the economy, and I get that, but nothing’s resonating with me and my pay packet.”

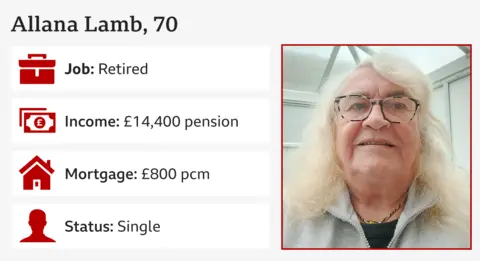

‘My pension of £1,200 a month doesn’t cover my outgoings’

Allana Lamb is an army and navy veteran and a retired social worker. She is a couple of pounds over the threshold for pension credit so she does not get the winter fuel allowance.

“I am very concerned about the government stopping it,” she says. “Yes, [the state pension] is triple locked but it doesn’t cover the cost of living.”

She feels “the rich are going to get richer” from this Budget and that “those at the bottom of the pile or on the cusp of the bottom” will be hit with more taxes.

Allana gets both the full state pension and a small army pension, totalling £1,200 a month. She says her income isn’t enough for all of her outgoings, and expects her mortgage to “virtually double” in the next few years. “That’ll put me in negative monthly outgoings.”

Allana also thinks the threshold for getting some council support to pay for social care costs should be raised. Currently people with assets up to £23,250 qualify. Labour has already scrapped plans to increase this.